New Office Leasing Beats Pre-Pandemic Numbers in Two Columbus Suburbs

Discounted Rent, Strategic Location Are a Draw for Tenants

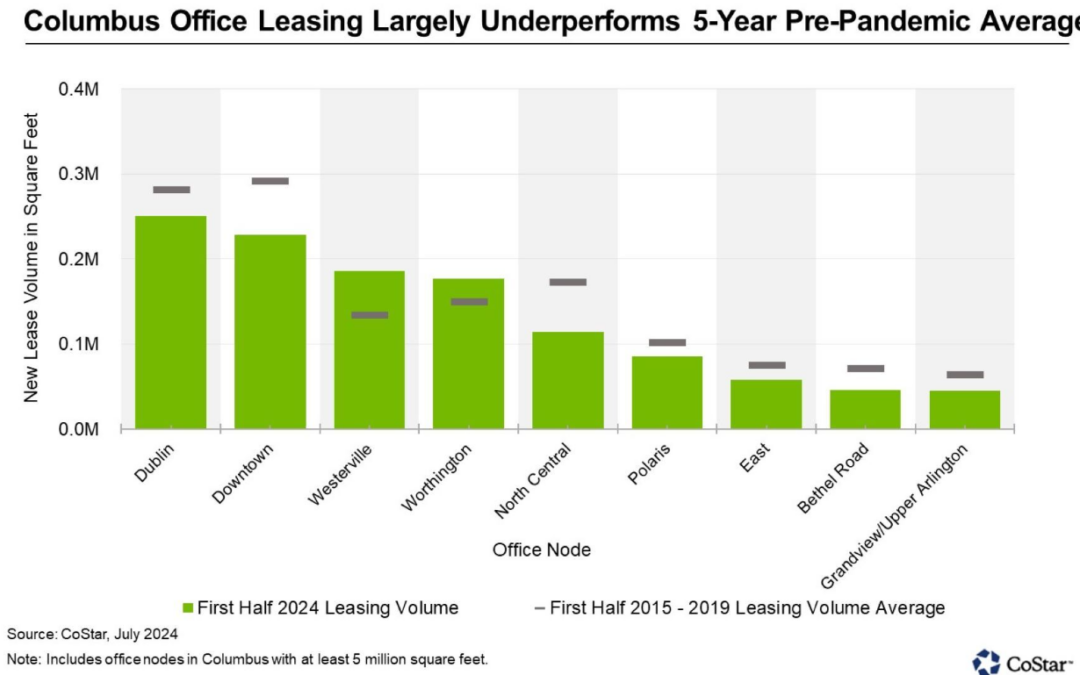

Though office leasing in Columbus, Ohio, remains below pre-pandemic levels, two of the market’s fast-growing suburbs are bucking the trend.

Leasing volume in the northern suburbs of Westerville and Worthington increased in the first half of the year, outpacing the average over the same period between 2015 and 2019. The Westerville office node also includes suburbs east along state route 161 such as Huber Ridge and New Albany, which is set to be home to Intel’s two semiconductor chip manufacturing facilities currently under construction. The Worthington neighborhood borders Westerville as well as some of Columbus’ most expensive office markets, including Polaris and North Central.

Both Westerville and Worthington see some of Columbus’ highest vacancy rates. That has kept office rents relatively affordable. New leases signed in these areas in the first half of the year have typically seen a 20% to 30% discount when compared to similar properties in neighboring areas.

In addition to lower rents, Westerville and Worthington are attractive to office tenants as they encompass some of the market’s fastest-growing suburbs and are strategically located along key roadways, including interstates 71 and 270. These areas will likely continue to capture ancillary demand from Intel’s project in New Albany as suppliers for the manufacturer move into the region.

The increased activity comes in stark contrast to the leasing trends seen during the pandemic with office tenants on average signing smaller deals while shedding space.

While the number of new office leases signed in the first half of the year in Columbus was just slightly below the average over the same period between 2015 and 2019, new lease volume is down 10% from pre-pandemic levels.

Similar dynamics are seen across Columbus’ largest concentrations of office properties such as Dublin, Downtown and North Central where office leasing volume in the first half of the year is 10% to 30% below the pre-pandemic average.

While new lease volume in most of Columbus’ primary office nodes underperforms the pre-pandemic average, the overall market is faring better compared to peer markets and the United States overall. In the first half of the year, the U.S. volume of new leases was down 10% from the 2015-2019 average compared to just 1.5% in Columbus.

Columbus’ outsize exposure to non-cyclical sectors, such as government and education, and limited additions of new office inventory over recent years, support overall market conditions.